Let’s Talk About Property Taxes (2023 edition)

(this is an updated version of an article first released in 2021. To access that article, click here).

Colorado homeowners are in the process of receiving NOTICE OF VALUE letters in the mail from their local assessor's office. These letters are sent out every odd year and the updated values play a role in determining whether or not homeowners' property tax bills will increase or decrease over the following two years.

2023, in particular, is a year of attention as the Denver metro is coming off twenty-four months of above-average home value appreciation, leaving many to rightfully wonder what the impact of higher home prices will be on their property taxes.

A second reason for extra attention is people’s curiosity for what to expect with property taxes following the recent repeal of The Gallagher Amendment. Dating back to 1982, the Gallagher Amendment put a sort of cap on what Colorado homeowners could expect to pay in property taxes, and in so doing, simultaneously put a disproportionate strain on commercial property owners. The state has yet to solidify a sustainable, affordable long-term replacement plan.

What do property taxes pay for?

Just over half of the property tax revenues goes to pay for schools. The remainder goes to pay for local government services like fire protection, police, libraries, road maintenance, etc.

Property taxes do NOT pay for state services or enterprises like colleges, the lottery, prisons, or highways.

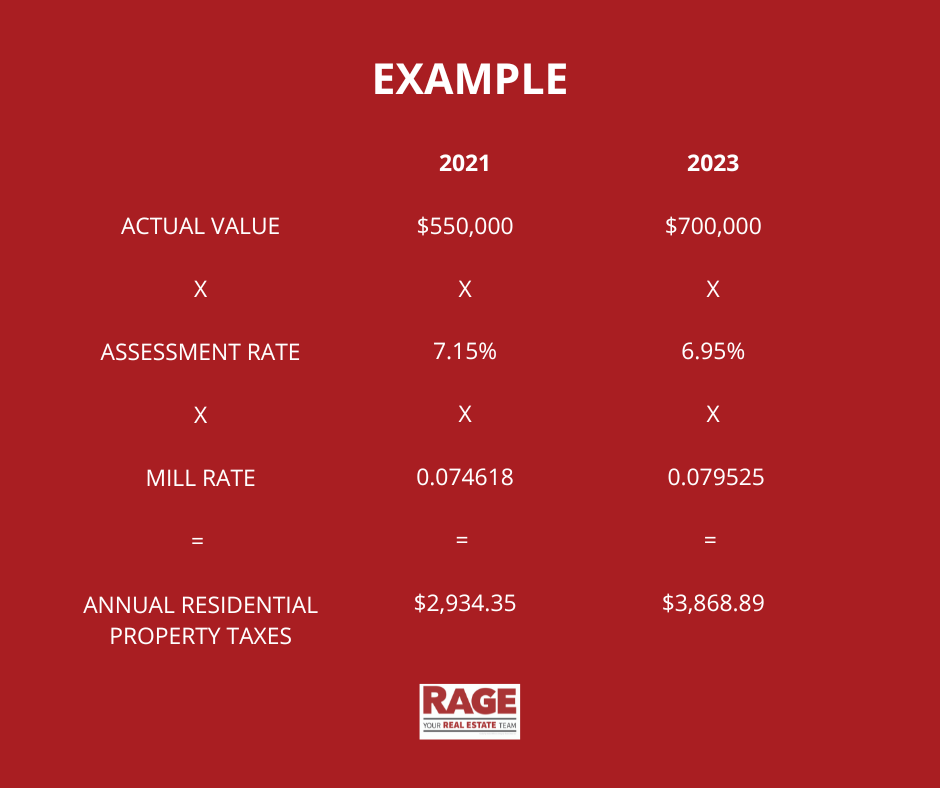

How are property taxes calculated?

Actual Value is the assessor's office's market value of your home as of June 30, 2022 based on the reported condition of the property on January 1, 2023 (i.e. if your home was in the process of being built, remodeled, or expanded at that time, the assessor's NOTICE OF VALUE will likely not take into account those changes). Think of this sort of like the city's version of a Zestimate®.

Note: The Denver market experienced its peak run of appreciation during the twenty-four months leading up to June 2022. Regardless of how the market might have corrected or adjusted since that time, “actual value” appraisals are based on a pre-assigned time frame and thus might not reflect current market value in spring 2023.

Assessed Property Value is a percentage of the Actual Value based on the state's assessment rate. In Colorado, this rate is currently fixed at 7.15% (though thanks to SB23-108 the rate is temporarily lowered to 6.95% for 2022 and 6.765% for 2023) for residential properties and 29% for non-residential. In other words, a $100,000 house would have an Assessed Property Value of $6,765. Property taxes are based on the ASSESSED value, not the ACTUAL value.

Mill Levy is based on the mill rate - the accumulation of all tax mills approved by voters in a particular jurisdiction. "Mill levy" can be an odd term and it has nothing to do with a cotton or flour mill. Mill, in this context, is from the Latin word millesimum meaning 1000th. Local ballots commonly provide opportunity for residents to vote for or against specific tax increases that show up in the form of increased "mills."

In 2022, Denver's combined general millage or Mill Rate including Denver Public Schools and Urban Drainage District was increased by roughly 5.5 mills to a new rate of 79.525 mills, or a tax rate of 0.079525 for every $1 of assessed value.

FAQs

Does a higher actual value automatically mean I'll have to pay more in property taxes?

An increase in ASSESSED value does NOT necessarily mean your property taxes will go up. Taxes are based on the mill levy, and Mill rates are set in December of each year by the various taxing authorities (City and County of Denver, Denver Public Schools, and any special districts). In other words, a home with a higher assessed value in a jurisdiction with a lower mill rate might have lower property taxes.

How do I pay for this difference?

Assuming you have a mortgage on your home and make automated monthly payments, at the appropriate time your lender will send you a letter notifying you of the opportunity to either pay off this "gap" in one single payment or to spread it out over twelve months via your automated monthly payments. There should be no interruption to your pay schedule or action needed on your behalf. You'll just notice a slightly modified monthly amount being paid out each month.

What if I believe my Actual Value in my NOTICE OF VALUATION is too high?

The City and County of Denver provides instructions on their NOTICE OF VALUATION letter for how a homeowner can contest their home value. This can be done via mail or online. These appeals must by submitted by June 8, 2023.

https://www.denvergov.org/Government/Agencies-Departments-Offices/Agencies-Departments-Offices-Directory/Department-of-Finance/Our-Divisions/Assessors-Office/Protest-Property-Values

What's the plan for the post-Gallagher Amendment era?

In short: no one knows yet.

Colorado voters repealed The Gallagher Amendment in 2020 (read more on that here), thereby opening the door for long-overdue changes to the structure of property tax billing in the state of Colorado.

People knew this restructuring would take time and likely require roll-outs in phases, as the immediate consequences of simply “ripping off the band aid” would have proven too costly for many Colorado homeowners who purchased their homes until the previous tax structure.

As part of the repeal, the state legislature locked in the residential assessment rate (RAR) at 7.15%, with a temporary lowering of the rate to 6.95% while the state seeks to formulate an affordable, sustainable solution for home owners.

So, how much will this increase cost me?

The removal of the “cap” created by The Gallagher Amendment combined with the recent spike in home values (in many areas, home values climbed by 30-50% since the previous assessment cycle) is almost guaranteed to lead to a corresponding increase in property taxes for homeowners - likely in the $25-$150/mo range.

For furthur reading, an extended analysis by Colorado organization Colorado Concern is available here.

We hope this content serves you well as you seek to be savvy homeowners and make wise financial decisions for your future. If you'd like to chat further or are considering moving in the coming months or year, let's get a meeting scheduled today!

Josh & The RAGE Team

or subscribe to receive regular real estate articles and helpful updates like this

This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for tax, legal, or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.